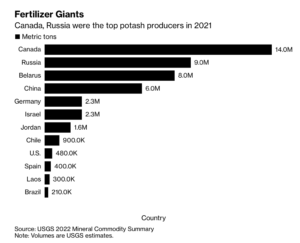

At the end of last week, Bloomberg Writers Elizabeth Elkin, Jen Skerritt and Tarso Veloso Ribeiro reported that, “A Belarusian potash miner who accounts for a major share of the world’s supply has declared force majeureshaking up a market already faced with soaring prices.

“Belaruskali said around February 16 that he will not be able to honor its contracts, according to a letter from an exporter to customers seen by Bloomberg. The shipments were stopped following the United States and Europe punishments.

The lack of Belarusian supplies will have great consequences.

“Potash is a key nutrient for major staple crops like corn and soy, as well as products. Fertilizer prices have already soared as soaring natural gas prices have forced some European factories to shut down or reduce production, and U.S. Potash Spot Price in the Corn Belt have almost double in the last year. Expensive fertilizers make food more expensive to produce and contribute to higher global inflation for consumers.

Meanwhile, Bloomberg Writers Elizabeth Elkin and Tarso Veloso Ribeiro reported last week that “Supply Shortage Threatens to Spike Prices of World’s No. 1 Weedkillermaking food production even more expensive for farmers.

“A major supplier of an ingredient of glyphosate — a herbicide widely used by But, soy, cotton and other farmers around the world — stop production due to mechanical failures, and repairs may take three months. Bayer AG, the maker of Roundup, whose active ingredient is glyphosate, declared a case of force majeure on February 11which means he might not be able to meet his sales agreements. »

The Bloomberg article added that “Bayer had previously said that The price of glyphosate increased by 25% between January 2021 and Novemberand the company expected prices continue to rise.”

Bloomberg’s Michael Hirtzer reported on Friday that “American poultry farms have yet another production headache to manage: bird flu.

“For the first time in several years, fatal cases of avian flu have struck farms in Indiana, Virginia and Kentucky recently. This prompted some nations such as Mexico to ban or limit imports from certain regions, and there is a risk that other brakes are on the way.

Hirtzer explained that “although export disruptions could in theory leave more supplies stranded in the United States – and lower poultry and egg prices there – importers may not want to stop shopping too long with bird flu elsewhere in the world too and demand remains robust.

“Retail prices for chicken breasts in America have reached a record last month before the virus hits farms there, while the cost of big eggs hit the highest since 2018.”

Federal Reserve officials also pointed to rising input costs in the agricultural sector at their meeting last month.

Minutes of their Meeting of January 25 and 26 indicated that “a few participants noted that agricultural businesses experienced higher input costsand these higher costs put stump on the finances of these companies even as they experienced generally strong demand for their products.

And Brett Forrest and Will Horner reported in the Wall Street Journal on Saturday that “the possibility of a invasion looms on the horizon on the Ukrainian economy, with massive Russian naval exercises already threatens to stifle agricultural exports of a country that is a major global supplier of corn and wheat.

The Journal article stated that “A blockade could jeopardize these exportsthat represent 12% and 13%respectively, of all world wheat and maize exports, according to data from the US Department of Agriculture. Agriculture accounted for 45% of Ukraine’s exports and 10% of its gross domestic product in 2020, making it the third largest sector of the economy, according to the World Bank.

Saturday’s article explained that “any prolonged disruption would affect a host of businesses and countries, including Chinawho did Ukraine at the center of its efforts to increase food security.

“Beijing was the top importer of Ukrainian grain last yearaccounting 21% of the country’s grain exports. Ukraine exported a record 8.2 million tonnes of maize to China in 2021including nearly 30% total imports of Chinese maize.